Navigating New Zealand's Economic Waters: A Comprehensive Guide to the…

페이지 정보

작성자 Ima 작성일23-12-22 18:13 조회555회 댓글0건관련링크

본문

In the intricate fabric of New Zealand's economic framework, the Reserve Bank of New Zealand (RBNZ) stands as a pivotal force, influencing monetary policy and financial stability. This comprehensive guide explores the multifaceted role of the RBNZ, emphasizing its commitment to maintaining price stability and fostering sustainable economic growth. Examining its historical journey, ownership structure, governance, and strategic tools, this exploration not only looks back at the RBNZ's contributions but also forward to its enduring impact on New Zealand's economic trajectory.

Historical Evolution of the Reserve Bank of New Zealand

Historical Evolution of the Reserve Bank of New Zealand

Founded in 1934 during the economic challenges of the Great Depression, the RBNZ was entrusted with a broad mandate covering currency issuance, banking regulation, and interest rate setting. Its journey, akin to the resilient silver fern, weathered global upheavals, including World War II and geopolitical shifts. A significant turning point occurred in 1989 with the Reserve Bank of New Zealand Act, refocusing the RBNZ on a paramount objective—price stability. This historical evolution underscores the institution's adaptability and steadfast commitment to New Zealand's economic stability and growth.

Ownership Dynamics: Singular Alignment with National Interest

Unlike conventional models, the RBNZ's ownership is distinctive, firmly tied to the national interest. The New Zealand government, represented by the Minister of Finance, serves as the sole shareholder. This unique ownership model emphasizes a commitment to broader objectives beyond profit, fostering a financial interdependence that channels profits back into the state's coffers. In an era where institutions balance public responsibilities with private gains, the RBNZ's ownership structure reflects a dedication to national economic well-being.

Governance Structure and Appointment Protocols

The governance architecture of the RBNZ centers on the appointment of the board and the Governor, a meticulous process overseen by the Minister of Finance. The board, appointed for strategic effectiveness, plays a crucial role in ensuring the RBNZ operates in alignment with its objectives. The Governor, with a five-year term and potential reappointment, assumes a pivotal role in implementing monetary policy. This governance structure goes beyond formality, serving as a linchpin for the seamless execution of the RBNZ's mandate.

Mandate and Dynamic Tools for Economic Management

Embedded in New Zealand's constitutional fabric, the RBNZ's mandate directs efforts toward maintaining price stability and fostering sustainable economic growth. The Official Cash Rate (OCR), a versatile instrument, stands at the forefront of the RBNZ's toolkit, influencing borrowing costs and spending patterns to manage inflation. Interest rate adjustments, open market operations, and regulatory tools further contribute to the RBNZ's strategic symphony, ensuring a delicate balance between stability and growth.

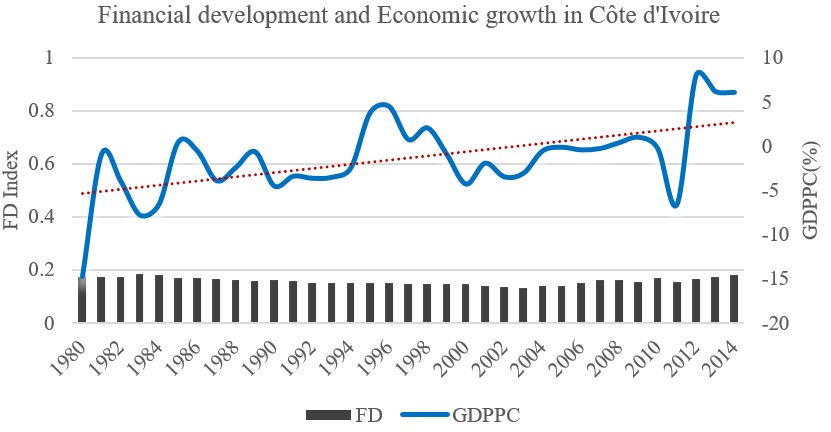

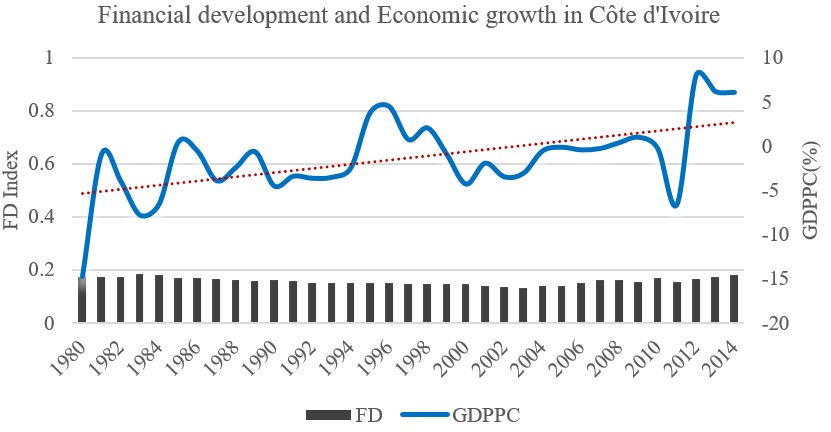

Illustrative Chart: Unraveling the Relationship between Interest Rate Hikes and Inflation

The historical chart serves as a visual narrative, unveiling the intricate dance between interest rate hikes and inflation under the RBNZ's guidance. Each data point represents a chapter in the RBNZ's strategic decisions, illustrating the lagging effect and the dynamic relationship influenced by external factors. This illustrative chart tells a story of not just decisions but consequences, showcasing how the RBNZ, through its choices, conducts the economic symphony of New Zealand.

Conclusion: RBNZ as a Guardian of Economic Equilibrium

As this guide concludes, the RBNZ emerges as a stalwart guardian of New Zealand's economic equilibrium. Its strategic tools, historical resilience, and commitment to national prosperity reinforce its enduring importance. Recognizing the RBNZ's pivotal role extends beyond past achievements, acknowledging its ongoing impact on shaping New Zealand's economic landscape.

Historical Evolution of the Reserve Bank of New Zealand

Historical Evolution of the Reserve Bank of New ZealandFounded in 1934 during the economic challenges of the Great Depression, the RBNZ was entrusted with a broad mandate covering currency issuance, banking regulation, and interest rate setting. Its journey, akin to the resilient silver fern, weathered global upheavals, including World War II and geopolitical shifts. A significant turning point occurred in 1989 with the Reserve Bank of New Zealand Act, refocusing the RBNZ on a paramount objective—price stability. This historical evolution underscores the institution's adaptability and steadfast commitment to New Zealand's economic stability and growth.

Ownership Dynamics: Singular Alignment with National Interest

Unlike conventional models, the RBNZ's ownership is distinctive, firmly tied to the national interest. The New Zealand government, represented by the Minister of Finance, serves as the sole shareholder. This unique ownership model emphasizes a commitment to broader objectives beyond profit, fostering a financial interdependence that channels profits back into the state's coffers. In an era where institutions balance public responsibilities with private gains, the RBNZ's ownership structure reflects a dedication to national economic well-being.

Governance Structure and Appointment Protocols

The governance architecture of the RBNZ centers on the appointment of the board and the Governor, a meticulous process overseen by the Minister of Finance. The board, appointed for strategic effectiveness, plays a crucial role in ensuring the RBNZ operates in alignment with its objectives. The Governor, with a five-year term and potential reappointment, assumes a pivotal role in implementing monetary policy. This governance structure goes beyond formality, serving as a linchpin for the seamless execution of the RBNZ's mandate.

Mandate and Dynamic Tools for Economic Management

Embedded in New Zealand's constitutional fabric, the RBNZ's mandate directs efforts toward maintaining price stability and fostering sustainable economic growth. The Official Cash Rate (OCR), a versatile instrument, stands at the forefront of the RBNZ's toolkit, influencing borrowing costs and spending patterns to manage inflation. Interest rate adjustments, open market operations, and regulatory tools further contribute to the RBNZ's strategic symphony, ensuring a delicate balance between stability and growth.

Illustrative Chart: Unraveling the Relationship between Interest Rate Hikes and Inflation

The historical chart serves as a visual narrative, unveiling the intricate dance between interest rate hikes and inflation under the RBNZ's guidance. Each data point represents a chapter in the RBNZ's strategic decisions, illustrating the lagging effect and the dynamic relationship influenced by external factors. This illustrative chart tells a story of not just decisions but consequences, showcasing how the RBNZ, through its choices, conducts the economic symphony of New Zealand.

Conclusion: RBNZ as a Guardian of Economic Equilibrium

As this guide concludes, the RBNZ emerges as a stalwart guardian of New Zealand's economic equilibrium. Its strategic tools, historical resilience, and commitment to national prosperity reinforce its enduring importance. Recognizing the RBNZ's pivotal role extends beyond past achievements, acknowledging its ongoing impact on shaping New Zealand's economic landscape.

댓글목록

등록된 댓글이 없습니다.